2026 is set to be an exciting year for the esports industry, especially from a competitive standpoint.

With major ecosystem changes for Counter-Strike and League of Legends implemented last year, these ecosystems now look primed to grow in 2026. The LCS and CBLOL are back, and IEM Cologne will host one of Counter-Strike’s Majors.

Moreover, 2026 will see Mobile Legends: Bang Bang introduce another franchised esports league, this time in Malaysia. Meanwhile, VALORANT teams will be clamouring for competitive success as their partner team contracts conclude at the end of this year.

As part of Esports Insider’s annual industry series, prominent stakeholders, such as the LEC, G2 Esports, Team Vitality, BLAST, Razer, VCT EMEA, Ninjas in Pyjamas, ESL, and many more, have predicted what will happen in 2026. This also includes discussing which esports scene to look out for in 2026, as well as what the industry needs to work on to grow.

This is part two of Esports Insider’s industry series; to find out what these stakeholders said about esports in 2025, click here.

- The top 10 most-watched esports events of 2025

- New format, same ending: four storylines that defined League of Legends esports in 2025

- A Year of Hope: Esports stakeholders review the industry in 2025

What Are Your Predictions for the Esports Industry in 2026?

Grant Rousseau, COO, Ninjas in Pyjamas

We’ll probably see more of the smaller, niche organisations close down, and more consolidation across the industry. At the same time, the larger, more stable groups will continue to find success and build more sustainable models. That’s been a focus for NIP Group as well, strengthening the core so we’re not as exposed to the ups and downs of the market.

We’ll also see a resurgence in some smaller titles thanks to Esports World Cup and BLAST investments. Chess will keep exploding within the esports audience, and India is going to become a key market for both global and local organisations, as the scale is just too big to ignore.

Jeffrey Chau, Global Head of Esports, Razer

We’re going to see continued consolidation – the same pattern that’s defined the last two years. The industry is shedding unsustainable models, and that process isn’t finished.

At the same time, hardware-driven performance will become the next major battleground as GPUs, monitors, and input devices push into the 1000Hz era. Not long ago, 144Hz felt premium; then 240–360Hz became standard, and 500Hz cracked open a new ceiling. The competitive edge is now defined by how deeply brands link product performance to real in-game advantage, and that shift will accelerate.

When it comes to rights, we expect more separation between athletes and teams. As organisations trim burn rate and chase healthier margins, the model will move closer to traditional sports: star players monetising their likeness and categories independently, while teams focus on scalable, team-level rights. It’s inevitable — and it favours the athletes who can actually move culture and trends, like Faker.

Akshat Rathee, Co-Founder and Managing Director, NODWIN Gaming

2026 will be a year of consolidation and recalibration. We will see more competition emerge around global nation-based events like the Esports Nations Cup, particularly from the Middle East. At the same time, esports will move further away from one-size-fits-all models and toward more title-specific ecosystems, each with its own commercial logic, fan base, and identity.

Vas Roberts, Co-CEO, Team Vitality

I expect that in 2026, the esports industry will continue to accelerate along the same path we’ve seen taking shape this year. The gap between top-tier esports organisations and the rest of the field will widen further, driven by business sustainability, diversification and stronger integration across gaming, media and technology. Sustainability will remain a key priority for organisations, and those that thrive will be the ones that build resilient business frameworks and identify additional revenue opportunities to expand into.

Esports is also entering a period of stabilisation, but I anticipate we’ll see increased consolidation, including mergers and acquisitions, as organisations look to strengthen their competitive position.

Monica Dinsmore, Head of Esports, Electronic Arts (EA)

We’ve already proven that esports is our most powerful engagement tool. In 2026, I expect the relationship between esports and game development to tighten even further, with pro player insights becoming a more integrated part of the development process.

Competitive play gives developers a real-time window into the habits and creativity of their most invested players. And with a more connected feedback loop, esports becomes positioned as an essential R&D tool, informing content and roadmap decisions and supporting long-term franchise health.

Artem Bykov, LEC Commissioner, Riot Games EMEA

In 2026, I expect the industry to continue moving toward more structured and sustainable ecosystems. Fans and players want competitive relevance year-round, and we’re seeing publishers respond with clearer, more integrated pathways from rookies to elite play.

For League of Legends, this means even tighter alignment between ERLs and the LEC, including the introduction of LEC Versus, where two of our strongest ERL teams will compete against LEC teams to kick off the 2026 competitive season.

Alban Dechelotte, CEO, G2 Esports

We’re starting to see this already, but a shift towards more sustainable esports ecosystems. Increased investment in structured grassroots programmes that develop talent from a young age and smarter financial decisions across the board will lead to healthy growth of the overall scene.

Streamers and content creators are definitely going to continue shaping the industry, with new creator-focused initiatives allowing them to grow their audiences further and compete with legacy organisations for consumer attention. Kings League and La Liga are great examples of this, showing the power of influencers in creating engaging new experiences for fans and building online communities.

In the same vein, I suspect we’ll keep seeing the line between sports and esports blurring as these hybrid experiences, that combine physical play with digital enhancements, continue to redefine entertainment and sport for younger audiences.

Lastly, I see the next big title on the horizon. League of Legends and Counter-Strike 2 have set the standard for competitive play, while Fortnite skyrocketed casual gaming into the mainstream eye, but there’s space for something new, hopefully next year.

Faisal bin Homran, Chief Product Officer, Esports World Cup Foundation

We will see clearer global hierarchies: Club champions, national champions, and eventually world champions under one competitive calendar. Esports as an industry spent a decade proving itself and its scale, and now, it will focus on structure and sustainability. The Esports Nations Cup, debuting in Riyadh next November, is part of that step and mirrors traditional sport in a way fans immediately understand.

Dominika Szot, VP of Growth, GRID

Data will become part of the spectator and entertainment experience. In 2026, data will shift from backend systems to the forefront of the entertainment experience across gaming and esports, shaping how audiences watch, play, and engage in real-time.

Just as traditional sports have embraced data-driven broadcast innovations such as Prime Vision, MaddenCast, and second-screen experiences, esports is following a similar path. GRID’s technology is already enabling predictive analytics during live broadcasts, richer post-match insights, and data-driven storytelling that keeps fans engaged well before and long after the final play.

We are also entering the second age of esports betting. Esports betting is entering its second age, driven by the rise of digitally native bettors who are becoming a meaningful share of the regulated sports betting market. This phase is defined less by experimentation and more by structure, scale, and long-term alignment.

What Does the Esports Industry Need to Work on in 2026?

Monica Dinsmore, Head of Esports, Electronic Arts (EA)

The industry has a clear opportunity to leverage national pride as an engagement engine. We’ve seen firsthand with the FC Pro Leagues and events like the UEFA eEURO that representation creates an immediate emotional connection for viewers.

That sense of national identity provides a critical onramp for viewers who may not intimately know the game mechanics but want to cheer for their country. With the return of the Esports World Cup and the Esports Nations Cup in 2026, leaning into this shared passion and identity will be key for growth. It’s a powerful, universal entry point for new audiences.

Ray Ng, Head of Esports Ecosystem, MOONTON Games

The big focus for 2026 has to be building more equitable, localised infrastructure — especially in emerging markets. There are still regions where players don’t have enough development pathways or commercial support to reach the next level.

We need to close that gap without losing the cohesion of a global competitive ecosystem. Long-term sustainability is crucial, and to achieve this, we need to focus on nurturing engaged player bases by growing grassroots communities, nurturing local partnerships, and fostering accessible competitive pathways. If we get that right, the industry can grow in a way that’s healthy and built to last.

Artem Bykov, LEC Commissioner, Riot Games EMEA

As esports matures, we need sustained investment in competitive integrity, regional identity, and long-term stability. For the LEC, this means deepening collaboration across the entire EMEA ecosystem and continuing to engage fans and players in ways that add real value to their experience. That’s not just about growing viewership, it’s about maintaining a strong connection between fans, players and the esports they love.

Alban Dechelotte, CEO, G2 Esports

Women in esports have made incredible progress over the last decade, on stage and behind the scenes, but there’s still more to be done. If I’ve learnt anything over the last 10 years, it’s that inclusion is not optional, and the industry needs to continue building tournaments, coaching opportunities, and leadership roles for women.

Robbie Douek, CEO, BLAST

We need to double down on sustainable economics, clearer value for teams, stronger commercial frameworks and more compelling products for brand partners. The industry also needs to take distribution more seriously.

Reaching audiences wherever they are, through co-streaming, localised content and non-linear formats, is essential. The future of competitive entertainment is deeply rooted in accessibility.

Artyom Odintsov, Co-Founder and CEO, Esports Charts

Multilingual coverage of esports events, similar to the language features YouTube has been rolling out for video content, will be key. YouTube recently expanded its AI-powered multi-language audio and translation tools, making it easier for creators and viewers around the world to access content in their language.

If similar technology is ever applied to live esports broadcasts, it could become a real killer feature— not only for fans, who could understand content regardless of the original broadcast language, but also for local brands, which could confidently invest in streams even without an official cast in their region, because viewers would still be able to follow the action.

Event organisers also need to better support teams in promoting their sponsors, which will strengthen the ecosystem for Tier‑2 and Tier‑3 teams and create new sponsorship opportunities.

Sebastian Weishaar, President of Esports, ESL FACEIT Group

The industry critically needs to work on strengthening the foundations of competitive structures and opportunities. This means prioritising and investing heavily in the Tier 2 and Tier 3 structures to ensure we have deep, healthy pipelines for talent.

It also means building upon the success of new initiatives like the Esports Nations Cup to foster new, nation-based ecosystems and create a clear path for new stars to emerge from all corners of the world.

Vas Roberts, Co-CEO, Team Vitality

The esports industry must redefine and strengthen its monetisation models, and this needs to happen on two levels.

Firstly, publishers must take a more progressive role in how value is created and shared across the esports ecosystem. Their priority, and understandably, is the success and longevity of their IP/games, but if esports is to mature into a sustainable global industry, publishers must reimagine revenue-share models.

Secondly, the wider industry must evolve its approach to monetising fandom. Esports has some of the most passionate, digitally native communities in entertainment, but commercial translation of that engagement remains slow. It is important to find the right value exchange with fans to create a meaningful revenue stream.

Daniel Ringland, Head of VALORANT Esports EMEA, Riot Games EMEA

Sustainability has been a conversation in the industry for a long time now, but it is more important than ever for tournament organisers and esports organisations to understand how to be efficient and effective in what they do.

By putting the community at the heart of every decision, you will be able to resonate with your audience and capture their attention, earning their loyalty for the long-term.

Adam Rosen, Founder and CEO, Rally Cry

Finding and creating opportunities for avid gamers who are not elite professionals to compete online and in person. Imagine if there was only Major League Baseball and not college baseball, minor league baseball, high school and youth baseball.

That sport would be infinitely smaller (and less important) without competitive opportunities for non-professionals and an ecosystem that reinforces participation and fandom at all stages of life and for all skill levels.

What Challenges Do You Think the Esports Industry Will Face in 2026?

Jeffrey Chau, Global Head of Esports, Razer

Publisher control vs. team survival: Teams still have limited structural leverage. If publishers and teams don’t realign their incentives, we’ll continue to see ecosystems collapse or consolidate. Any scene without a shared economic upside will remain fragile.

Monetisation stagnation: Most teams are still overexposed to sponsorship revenue. Without diversified income stream frameworks (like the Razer x Sentinels model), the economy won’t stabilise. Sponsorships alone cannot carry an entire industry – there are too many mouths to feed and still not enough to go around.

The creator-driven cultural shift: Audience loyalty has shifted toward individuals, not organisations. Some organisations were built for a 2018-era team-first world, not a 2026 creator-first world. If they don’t adapt, they’ll lose relevance and negotiating power.

Sebastian Weishaar, President of Esports, ESL FACEIT Group

The industry will face the challenge of managing rapid global expansion sustainably while adapting to major shifts in content consumption. We need to ensure that the expansion into new territories creates lasting ecosystems rather than just temporary event stops.

At the same time, we should enhance working with influencers and UGC (User-Generated Content) platforms to ensure competitive esports remains central to the broader ‘gaming entertainment’ landscape.

Daniel Ringland, Head of VALORANT Esports EMEA, Riot Games EMEA

Esports, like most industries, is fighting for the valuable time and attention of its audience. For this reason, I feel like the main challenge will be, and likely continue to be, earning this attention and making key information as simple to digest as possible. Streamlining complexity into simplicity that makes the barrier between broadcast and viewership as thin as possible.

Monica Dinsmore, Head of Esports, Electronic Arts (EA)

A major ongoing challenge is improving diversity and inclusivity within gaming communities. With over 80% of gamers experiencing some form of online harassment, the industry must continue to work to safeguard players and competitors from toxicity, verbal harassment, and bullying.

We’re committed to continue championing positive play, elevate role models, and maintain spaces where competitors of all backgrounds can thrive.

Ray Ng, Head of Esports Ecosystem, MOONTON Games

One of the biggest challenges in 2026 will be balancing global expansion with maintaining the quality and community-driven nature of esports. As titles like MLBB continue to expand — even reaching mainstream platforms like the Asian Games — we have to make sure this growth doesn’t dilute the connection between fans and their local talent. That means investing in ecosystems that reflect each region’s needs rather than relying on a one-size-fits-all approach.

This also leads to another challenge, which is navigating the overlap between esports and traditional sports. There’s a lot of opportunity there, but we need to stay true to what makes esports unique while also meeting the expectations of broader audiences and governing bodies.

Robbie Douek, CEO, BLAST

The biggest challenge will be navigating consolidation while still fostering innovation. As the industry matures, the bar for quality rises, costs rise with it, and only the strongest operators will be able to deliver at a global scale. We’ll also see a continued spotlight on monetisation, ensuring that the commercial side keeps pace with fan demand.

Grant Rousseau, COO, Ninjas in Pyjamas

Global economics as current may unfortunately see further withdrawal of marketing and partnership spends from large corporations. Finding strong, long-term partners may be more difficult than in 2025, and the traditional methods of revenue may struggle.

Akshat Rathee, Co-Founder and Managing Director, NODWIN Gaming

One of the biggest challenges will be exits. Many esports companies have taken institutional capital, and as fund cycles end, pressure to exit will increase, sometimes even when businesses are operationally strong. This could lead to consolidation at lower-than-expected valuations. Navigating this phase without disrupting ecosystems will be critical.

What Are Some of Your Targets for Next Year?

Ahead of the new year, Esports Insider asked esports stakeholders what their targets are for 2026, both from a competitive and business standpoint. Esports Insider has summarised these below.

Robbie Douek, CEO, BLAST: Deepening BLAST’s global infrastructure, expanding its work with the “world’s biggest publishers,” and elevating the competitive product for fans. This means creating even more arena shows, expanding its mobile operations following the Brawl Stars partnership, and innovating into new formats that bring “creators, culture and competition” closer together.

Monica Dinsmore, Head of Esports, EA: To maintain the momentum that EA has built in 2025 while also “balancing that proven success with calculated innovation.” This includes experimenting with “fresh formats that unlock new opportunities and experiences” for EA’s players.

Sebastian Weishaar, President of Esports, ESL FACEIT Group: To deliver an “unforgettable” Counter-Strike Major at IEM Cologne, the first in a decade. To continue supporting the Esports World Cup Foundation and the Esports Nations Cup. As a business, ESL FACEIT Group’s target is to serve its players, fans and publisher partners “as well as we possibly can” while running a sustainable business.

Artyom Odintsov, Co-Founder and CEO, Esports Charts: “To build analytical tools that allow new brands and sponsors in esports to accurately measure the impact of their integrations.”

Alban Dechelotte, CEO, G2 Esports: Competitively, getting international titles for League of Legends and VALORANT, as well as continuing its Counter-Strike 2 rebuild. Business-wise, to be less dependent on competitive performance.

Artem Bykov, LEC Commissioner, Riot Games EMEA: To strengthen EMEA’s presence internationally by elevating the LEC’s level of play and reinforcing its talent pipeline through the ERLs. To build on the success of LEC’s live events in EMEA by “evolving our Roadtrip concept.” From a product perspective, pushing to innovate, whether that’s modernising its broadcast or experimenting with new formats like LEC Versus.

Ray Ng, Head of Esports Ecosystem, MOONTON Games: To deliver an M7 World Championship that “showcases the host nation and how esports has become part of its sporting culture.” To further expand its women’s ecosystem by giving female athletes more opportunities to compete, develop, and be recognised on the world stage.

Another goal is to advance its global expansion plan, giving more regions the tools to build stronger ‘amateur to pro’ systems. On a business front, a focus will also be to strengthen MLBB’s footprint in emerging regions. This means investing in regional and local leagues, community programmes, and fan engagement initiatives.

Grant Rousseau, COO, Ninjas in Pyjamas: Competitively, for Ninjas in Pyjamas to return to “the legacy of old. We aim for high ambitions as we continue our improvement within CS, alongside consistency in high-level performance across our other titles.”

Akshat Rathee, Co-Founder and Managing Director, NODWIN Gaming: From a business perspective, to target “15–40% growth through a mix of organic expansion and selective inorganic investments.”

Adam Rosen, Founder and CEO, Rally Cry: To expand its competition platform. “We have seen great success developing differentiated formats that uniquely connect players in traditionally challenging-to-operate games.”

Jeffrey Chau, Global Head of Esports, Razer: To cement Razer as the #1 brand across all esports gear (mice, keyboards, headsets, mousepads, and chairs). To expand multi-category partnerships with esports brands and/or athletes. Driving “deeper integration between pro-tuned performance features (like Rapid Trigger, 8KHz, Pro Audio Profiles) and game-specific narratives” across various esports titles.

Finally, strengthening and scaling its global esports operations so that activations, from tournaments to digital campaigns, deliver “meaningful experiences.”

Vas Roberts, Co-CEO, Team Vitality: “Becoming the best esports organisation in the world.”

Competitively, to replicate the success of its CS2 team across every title it competes in. From a fan-growth perspective, to expand its communities by reaching new audiences across different markets.

From a business perspective, to strengthen the foundations “that drive long-term value, including investing in new rosters and enhancing capabilities to deliver measurable ROI” for commercial partners.

Daniel Ringland, Head of VALORANT Esports EMEA, Riot Games EMEA: To create moments that fans love and remember. To create higher-stakes opportunities through new formats, including its new triple-elimination bracket for the annual Kickoff tournaments.

Which Esports Title Will Grow the Most in 2026?

Vas Roberts, Co-CEO, Team Vitality

I expect the most significant growth to come from the mobile esports space. The rapid growth and expansion of mobile gaming is incredible, driven by accessibility and the ability to reach massive global audiences.

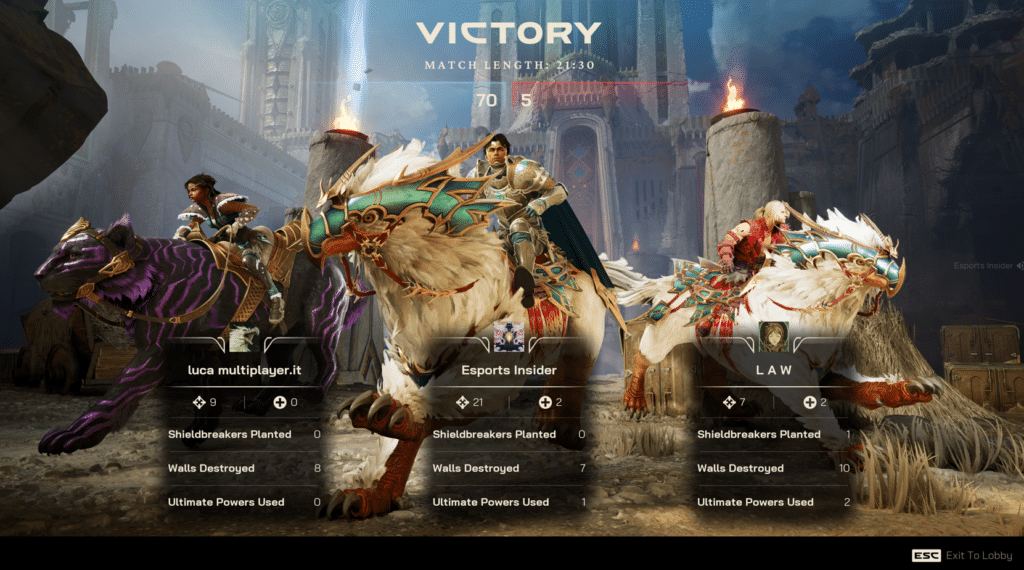

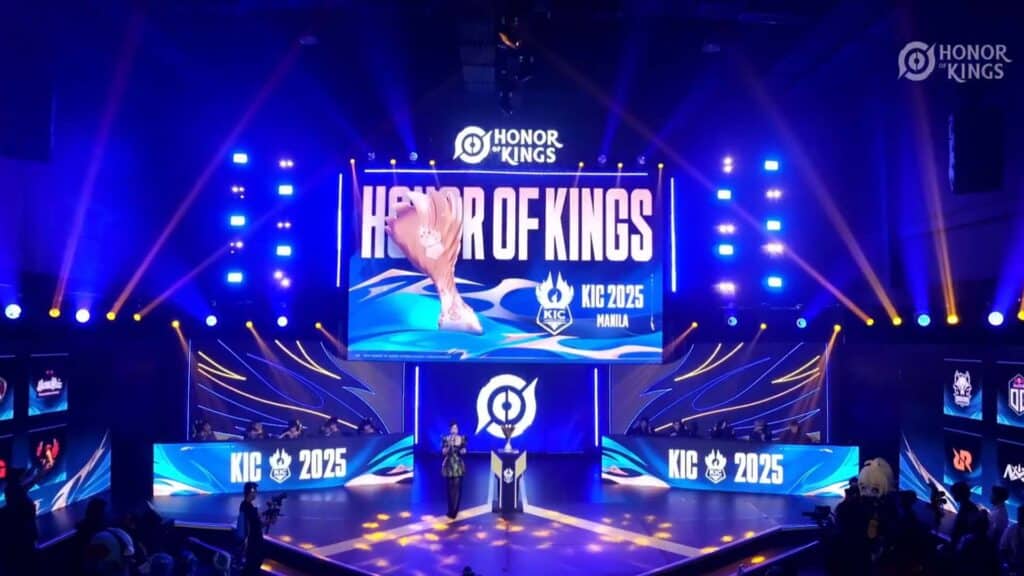

Titles like Honor of Kings and Mobile Legends: Bang Bang are the most likely to experience the biggest growth next year, given the highly engaged fan bases across key regions.

Robbie Douek, CEO, BLAST

I expect mobile esports to experience the sharpest growth curve, led by titles like Brawl Stars, which already has one of the most global and engaged player bases in gaming. As infrastructure and investment catch up with audience demand, mobile will become an increasingly important pillar of global competitive entertainment.

Faisal bin Homran, Chief Product Officer, Esports World Cup Foundation

Mobile Legends: Bang Bang, PUBG MOBILE and Honor of Kings — this region and its games are driving global communities, training talent, and carrying tournament traction. That curve isn’t slowing.

Artyom Odintsov, Co-Founder and CEO, Esports Charts

The relaunch of Free Fire in India will likely provoke significant growth and strong competition with BGMI. Mobile game developers are also exploring European and NA markets, so we’ll see their presence grow in 2026 as well.

It’s difficult to single out just one title, as each is popular in specific regions rather than globally. However, Magic Chess: Go Go is expected to see the highest percentage growth, with its first World Championship in January 2026, and some audience share likely shifting from Mobile Legends, thanks to the shared publisher MOONTON Games.

Akshat Rathee, Co-Founder and Managing Director, NODWIN Gaming

On PC, Counter-Strike will continue its upward trajectory following its strong Major performances and ecosystem stability. On mobile, Honor of Kings will keep setting benchmarks globally. In India specifically, we expect growth across Free Fire, BGMI, and fighting games, particularly as infrastructure and state-level support increase.

Jeffrey Chau, Global Head of Esports, Razer

We’re looking at several titles with strong growth potential in 2026, and one of the most notable is Fortnite. Epic continues to operate at an impressive velocity – shipping new content, mechanics, and experiences at a pace that keeps the ecosystem fresh and constantly expanding.

But the deeper reason Fortnite will grow is structural. Epic has built a creator-driven platform, not just a competitive title. Unreal Editor for Fortnite (UEFN) and the growing ecosystem around creator-made experiences are turning Fortnite into a programmable entertainment layer. Competitive modes also benefit from the overall ecosystem growth.

Alban Dechelotte, CEO, G2 Esports

Personally, I would like to see the growth of TFT, but VALORANT has had a huge boom recently, and it feels like there’s still more growth incoming. It’s been such an incredible year for VALORANT, and for us in VCT Americas going back-to-back-to-back with trophies — we’re excited to see what 2026 has to offer.

Grant Rousseau, COO, Ninjas in Pyjamas

Overwatch 2. A bold claim, I know, but there’s a real resurgence happening thanks to a more organic, patient rebuild from Activision Blizzard. There’s also a noticeable uptick from the MENA audience after their competitive success, and parity between Eastern and Western teams makes the big events much more fun to watch.

Are There Any Games That You Are Looking to Expand Into in 2026?

Jeffrey Chau, Global Head of Esports, Razer

Yes, we’re exploring multiple titles for expansion in 2026, guided by the right partners and tournament organisers. Some on our radar include Rocket League, Marvel Rivals, and Fortnite – along with any future titles that show strong global reach, competitive consistency, and strong hardware tie-in.

Alban Dechelotte, CEO, G2 Esports

Mobile Esports is probably the most obvious answer (MLBB). We haven’t found the right G2 approach for mobile games in the past few years, but we’re always looking for the right opportunity, and mobile esports as a whole is such an underserved market in Western audiences.

Akshat Rathee, Co-Founder and Managing Director, NODWIN Gaming

Cricket-based titles like Real Cricket have strong potential, especially with KRAFTON’s investment and global publishing ambitions.

Beyond that, games like chess, certain fighting games, and even casual titles such as Clash Royale or Ludo could find viable competitive formats. India is not a one-game market, and the next phase will see multiple titles co-existing and growing in parallel.

Sebastian Weishaar, President of Esports, ESL FACEIT Group

We are always evaluating new games, particularly those that show a strong commitment to open competitive ecosystems, to which DreamHack is the perfect location to start.

We have a few interesting plans in the pipeline that I’m not able to disclose just yet, but I’d love to see a new genre of games enter the space. We haven’t seen a new genre come for a while (basically since Battle Royale games became popular), and it’s time for that to change, if not in 2026, hopefully no later than 2027!

The post Esports stakeholders predict the state of the industry in 2026 appeared first on Esports Insider.