- Super League Enterprise is streamlining its operations, cutting costs, forging new partnerships, and diversifying revenue streams.

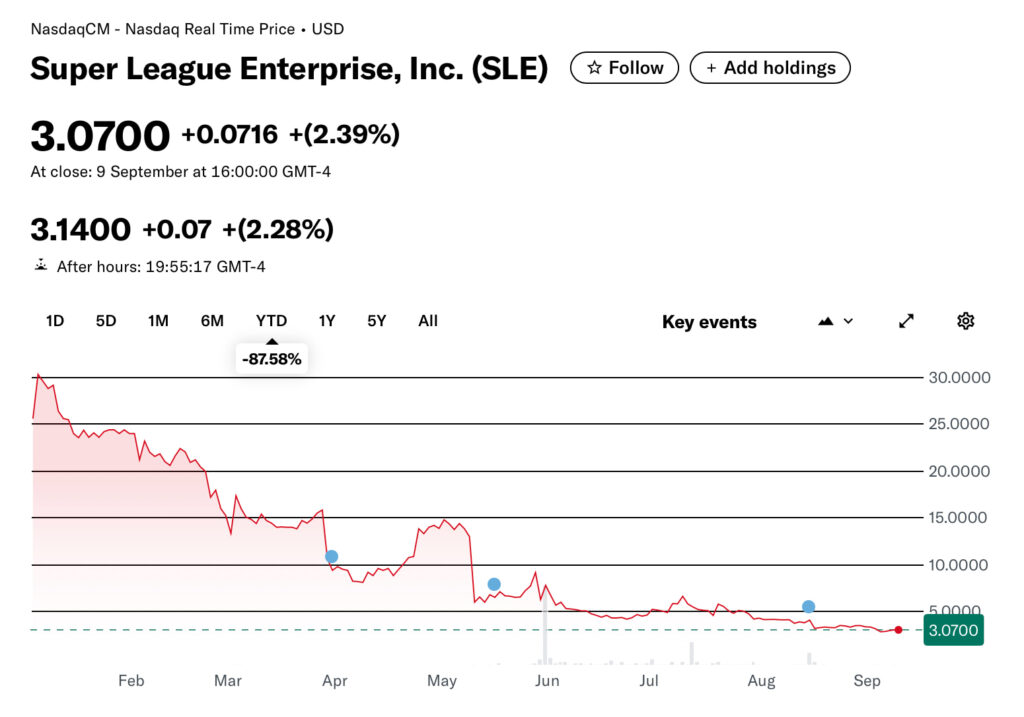

- The SLE stock price has slumped 93.21% over the past year and is down 87.58% since the beginning of 2025.

- A 1-for-40 reverse stock split was implemented in June 2025 to address a deficiency notice related to the $1.00 minimum bid price requirement for listing on the NCM.

- A loss of $2.78 million was reported for the three months ended June 2025, partly due to macroeconomic headwinds.

- SLE could see its share price rise 14% to $3.50 over the coming year, according to analyst views compiled by TipRanks.

Super League Enterprise aims to achieve sustainable profitability by streamlining its operations and diversifying its revenue streams.

The US-based company, which provides brands with ads, content and experiences, has seen its SLE stock price plummet due to financial losses. However, senior managers remain confident that the current overhaul, which includes forging new partnerships, will give a much-needed boost to investors.

In our SLE stock forecast 2025-2030, we look at the latest Super League news, the main share price drivers, and what analysts expect to see over the coming year.

Super League stock forecast 2025–2026: One-year SLE stock projection

The SLE share price could rise to $3.50 over the coming 12 months, according to two analyst reports compiled by TipRanks.

This would be 14% higher than its $3.07 level as the stock market closed on September 9, 2025. The site suggests this makes it a ‘moderate buy’.

Meanwhile, the algorithmic forecasts of Wallet Investor have more modest expectations, anticipating a slight increase to $3.11 by this time next year.

The site brands SLE stock as a “not so good long-term (1-year) investment”, although it’s worth noting that these predictions are data-driven with no analytical input.

Elsewhere, Coincodex predicts that the share price will remain pretty stagnant at $3.05.

Super League is currently the 10th largest esports company based on its $3.32 million market capitalisation, as of the close on September 9, 2025.

| One-year Super League Enterprise stock forecast (as of September 8, 2025) | |

|---|---|

| TipRanks | $3.50 |

| WalletInvestor | $3.11 |

| Coincodex | $3.05 |

Super League Enterprise stock predictions

How about the longer-term SLE stock prediction? What are the Super League Enterprise stock predictions of analysts and algorithmic forecasters for the next five years?

Unfortunately, there are relatively few predictions available from stock market analysts, making an accurate forecast challenging.

Wallet Investor’s SLE share price forecast predicts the stock will slip to $2.79 by September 2027, before recovering to $3.45 three years later. Coincodex, meanwhile, has a similar view. Its data suggests the stock will drop to $2.86 over the next two years before rising to $3.50 by September 2030.

Super League stock forecast 2027–2030: Longer-term prospects

| Long-term SLE stock forecasts (as of September 9, 2025) | ||

|---|---|---|

| Year | September 2027 | September 2030 |

| WalletInvestor | $2.79 | $3.45 |

| Coincodex | $2.86 | $3.50 |

SLE stock YTD, one-year & five-year performance analysis

Super League Enterprise stock year-to-date: -87.58%

The SLE share price has had a tough 2025. In its quarterly results, the company has announced declining revenue and substantial net losses.

Super League Enterprise stock one-year performance: -93.21%

Investor confidence has been adversely affected by factors such as declining revenues, large net losses and actions to bolster the balance sheet.

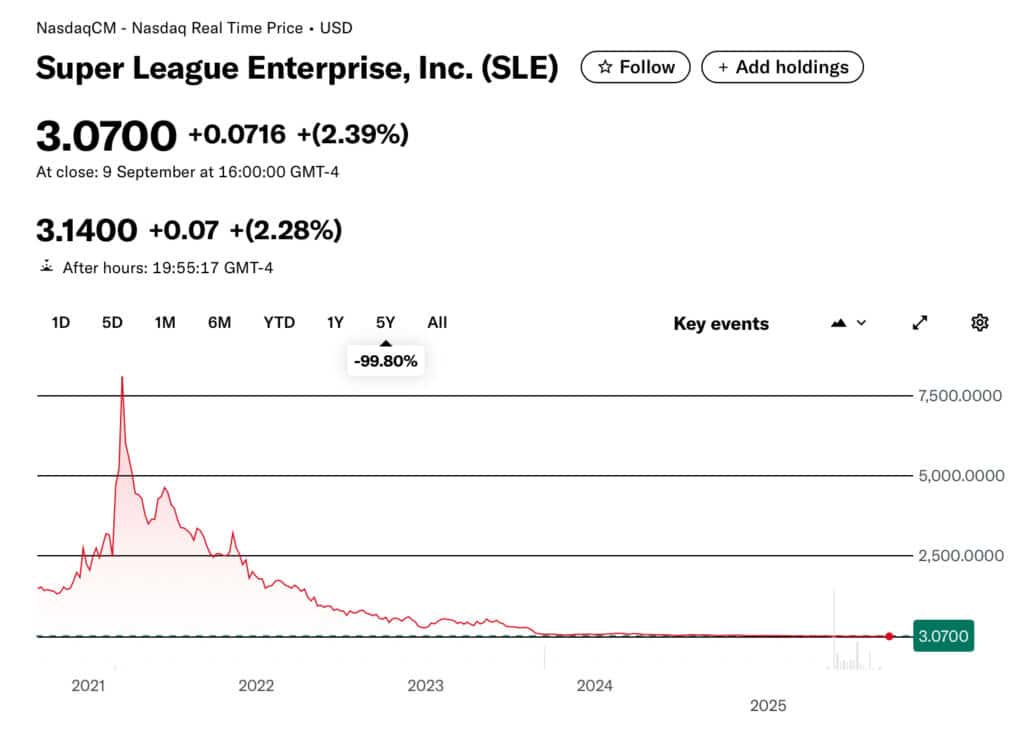

Super League Enterprise stock five-year performance: -99.80%

The SLE stock price has had a torrid time over the past five years, largely due to the potent combination of declining revenues and substantial net losses.

Latest earnings results

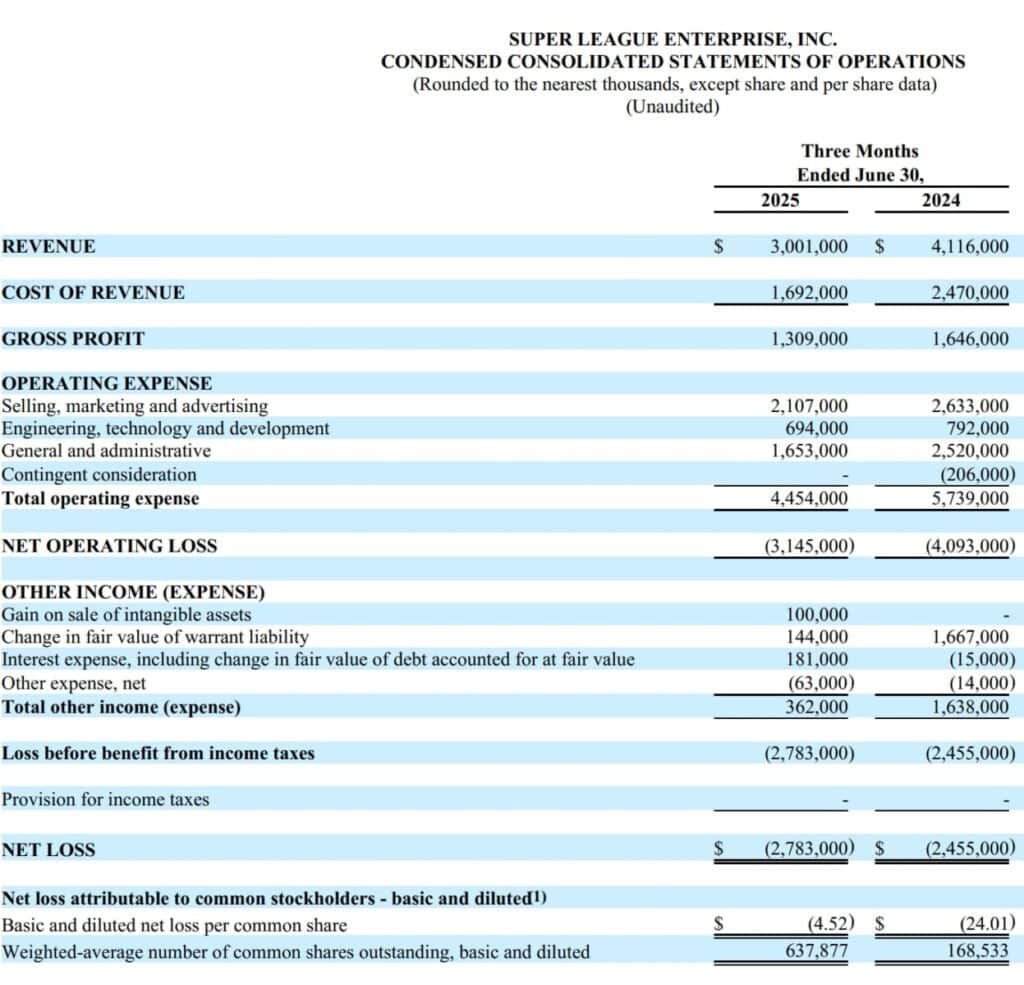

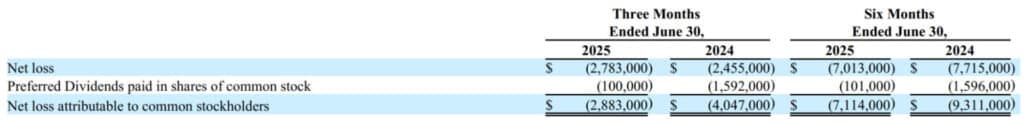

The company reported a $2.78 million loss for the three months ended June 2025, according to its most recent results.

This included a 27% year-over-year decline in revenue from $4.1 million to $3 million, which was partly due to macroeconomic headwinds attributable to tariff uncertainty.

It also highlighted the impact of completing the process of “adapting to the structural shifts” in the Roblox ad ecosystem.

This resulted in a quarterly loss of $4.52 per share.

However, SLE pointed out that its “relentless focus on higher margin revenue” was paying off, with a second-quarter gross margin of 44%, compared to 40% in the same period last year.

Speaking on a conference call with analysts, SLE chief executive Matt Edelman provided an upbeat assessment of the company’s achievements and prospects.

He said the second quarter had seen operations streamlined, important financial transactions closed, and new partnerships forged to help diversify revenue.

“Our accomplishments have realigned the company’s focus and put us on a determined path towards sustainable profitability,” he said. “Importantly, we continue to see a compelling long-term growth opportunity that validates our core mission.”

Super League Enterprise’s overhaul

Super League has been focusing on a substantial overhaul of its business, which has included cutting costs, streamlining operations and bolstering its financial position. Here, we examine some of these factors in more detail.

Cost reductions

The company introduced cost savings earlier this year, which it hopes will reduce fiscal year operating expenses by approximately $2.7 million by the end of 2025. This includes a 35% reduction in the workforce and a restructuring of management compensation.

It’s hoped this will help it become EBITDA positive (Earnings Before Interest, Taxes, Depreciation, and Amortisation) in the fourth quarter of 2025.

In a statement, chief executive Matt Edelman said: “While always challenging to part ways with valued members of our team, these necessary cost reductions taken together with our strategic realignment and industry consolidation trends position us well to capture key long-term growth opportunities inherent in connecting brands with massive consumer audiences through playable media.”

Streamlined operations

As far as other Super League news is concerned, the company sold Minecraft property InVPV to Mineville for $350,000 during May 2025.

It stated: “For Super League, the all-cash transaction is part of an ongoing initiative to streamline operations to focus on playable media and playable content solutions for global brands while reducing operating costs.”

As part of the transaction, Super League will become Mineville LLC’s exclusive partner for brand partnerships and advertising sales.

Financial situation

In mid-July 2025, the company announced a “set of strategic transactions” to bolster its balance sheet and reduce its remaining 2025 debt burden by approximately 90%.

New capital is being provided in the form of a $4.5 million Convertible Note, convertible into shares of Super League’s common stock at the option of the Purchaser.

It has also secured a further $20 million equity line of credit, providing it with a flexible source of funding to support future growth opportunities.

Matt Edelman commented: “Recent transactions have resulted in a more flexible capital structure and an improved balance sheet, making it possible for the company to pursue a broader range of strategic opportunities.”

Other Super League Enterprise news

1-for-40 reverse stock split

In June 2025, Super League Enterprise announced a 1-for-40 reverse stock split to reduce the number of shares of common stock outstanding from 35.4 million to around 884,000. The move, which saw every 40 issued and outstanding shares converted into one share, was needed for compliance purposes.

It stated: “The Reverse Split is necessary to cure a deficiency notice previously received by the Company from Nasdaq relating to the $1.00 minimum bid price required for continued listing on the NCM under Nasdaq Listing Rule 5550(a)(2).”

SLE had received a letter from Nasdaq on January 2, 2025, warning that it hadn’t been in compliance with the requirement to maintain a minimum bid price of $1 per share. However, it received a further notification from Nasdaq on July 8, 2025, confirming that it had regained compliance with the minimum bid requirement.

What is the outlook?

There is a tremendous opportunity for brands to connect with passionate and attentive audiences, according to SLE’s Matt Edelman.

He said: “Our research shows that there are more than five billion people in the world who play, with 3.32 billion playing video games.”

While immersive gaming platforms like Roblox, Fortnite and Minecraft have been the backbone, he highlighted mobile gaming as an exciting growth opportunity.

That inspired SLE’s exclusive partnership with AdArcade, whose patented playable ad format, according to Edelman, outperformed standard playable ads by 3x.

He added: “We now have access to the entire U.S. population of mobile gamers, representing more than 56% of the country, at 191 million people, advancing our ability to deliver scalable, brand-safe solutions to advertisers across every consumer segment while diversifying the Company’s revenue mix.”

In addition, it expects the bulk of digital ad spend will move towards 3D engagement and has been preparing for this eventuality.

Its offering includes a “powerful suite of tech and capabilities” that offer immersive experiences, proprietary products, creator tools and analytics.

What is Super League Enterprise?

Super League Enterprise is a creator and publisher of content experiences and media solutions for some of the world’s largest immersive platforms.

These include Roblox, Minecraft and Fortnite Creative, as well as bespoke worlds built using 3D creation tools.

The company, listed on the Nasdaq under the ticker SLE, provides brands with ads, content, and experiences.

It started out as Nth Games in October 2014 before changing its name to Super League Gaming in July 2015. The company underwent an IPO in February 2019 and two years ago became Super League Enterprise to better reflect its focus.

Conclusion: Should I buy Super League Enterprise stock?

No one can deny that the management at the helm of Super League Enterprise is committed to achieving sustainable profitability. As our SLE stock analysis illustrates, the company has already begun implementing plans to reduce its workforce, streamline operations, and diversify its revenue streams. However, a lot will depend on how successful they are in pursuing their goals over the coming year and turning around the financial situation.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is SLE stock a good buy?

You will need to answer this question based on your opinions and those of stock market analysts. Remember that even professional investors can make mistakes. Your SLE share price forecast should consider recent news flow, comments from the company, and views of the wider market.

What is the price prediction for Super League Enterprise in 2025?

As relatively few analysts cover the company, the algorithmic forecasts of Wallet Investor indicate that the SLE share price will slip to $2.65 by the end of 2025.

Is SLE stock overvalued?

This is something you’ll need to decide. The stock price has fallen considerably over the past year, but could rise 14% to $3.50, according to the Super League Enterprise stock forecast of analysts, as provided by TipRanks.

What is Super League?

It is a creator and publisher of content experiences and media solutions for some of the world’s largest immersive platforms.

These include powerhouses such as Roblox, Minecraft and Fortnite Creative, as well as bespoke worlds built using 3D creation tools.

References

- Super League Enterprise (SLE) Stock Forecast, Price Targets and Analysts Predictions (TipRanks)

- SLE Stock Price Prediction, Long-Term & Short-Term Share Revenue Prognosis with Smart Technical Analysis (Wallet Investor)

- Super League Enterprise, Inc. (SLE) Stock Forecast & Price Prediction 2025–2030 (CoinCodex)

- Largest Esports companies by Market Cap (Companies Market Cap)

- SUPER LEAGUE ENTERPRISE, INC. (SuperLeague)

- Super League Enterprise, Inc. Second Quarter 2025 Conference Call (Cloudfront)

- Super League Announces Cost Structure Reductions Amid Drive Towards Profitability (SuperLeague)

- CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934 (Sec Gov)

- Super League Completes Series of Transactions to Secure Capital and Strengthen Balance Sheet (SuperLeague)

- Super League Announces 1-for-40 Reverse Split (SuperLeague)

- QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (SuperLeague)

- LEADING THE FUTURE OF IMMERSIVE 3D ENGAGEMENT (Cloudfront)

The post Super League Enterprise stock forecast 2025-2030: Will the SLE share price rise over the coming months? appeared first on Esports Insider.